Enhance Governance, Risk, and Compliance (GRC) Frameworks Through Effective Risk Management

Posted in: News Item

Date Posted: 2024-01-31

Organization Name: 360factors

Location: USA

Governance, Risk, and Compliance (GRC) are three pillars that form the foundation of a robust organizational strategy. They are interconnected and essential for ensuring that a company’s operations align with its goals while adhering to legal and ethical standards.

Governance refers to the rules, practices, and processes by which a company is directed and controlled. It involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government, and the community.

Risk is associated with the methodology of identification, evaluation, and control for all kinds of risks an organization faces in the context of GRC. There are various risk categories, such as financial, legal, strategic, and security risks.

Compliance means conforming to regulatory rules, such as a specification, policy, standard, or law. Regulatory compliance describes the goal that organizations seek to achieve to ensure that they are aware of and take steps to comply with relevant laws, policies, and regulations.

3 Key Contributions of Risk Management to GRC

The dynamic nature of today’s business environment presents a spectrum of risks that can profoundly impact an organization’s operations and financial stability. Risk management within the GRC context is not merely a defensive tactic but a strategic imperative.

Organizations can significantly enhance their capacity to achieve strategic objectives while minimizing potential risks by proactively identifying, assessing, and mitigating risks with or without the aid of GRC software. Here are 3 main contributions of risk management to GRC:

1. Systematic Risk Identification and Analysis

One of the foremost contributions of risk management in GRC is its ability to provide a systematic process for identifying and analyzing potential threats. This process involves a thorough understanding of all possible risks that an organization might face. With this clarity of risk management in GRC, organizations are better positioned to allocate resources judiciously and implement adequate controls to mitigate identified risks.

2. Risk Mitigation and Monitoring

Once risks are identified and assessed, implementing appropriate risk mitigation measures is key for effective risk management. Implementing appropriate risk mitigation measures involves developing strategies and actions tailored to address specific risks. These strategies could range from avoiding the risk entirely, reducing the negative impact or likelihood of the risk, transferring the risk to another party, or accepting some or all the consequences of a particular risk.

3. Facilitating Strategic Decision-Making

Risk management, in the context of GRC, is also instrumental in strategic decision-making. Organizations can make more informed decisions by evaluating potential risks and their impacts. This process enables them to capitalize on opportunities while maintaining a prudent balance between risk and reward. Effective risk management empowers organizations to navigate uncertainties with greater confidence and foresight with the utilization of GRC software.

Enhancing Complete Visibility of Risks in a Unified GRC Software

In GRC, integrating technology plays a pivotal role in streamlining and enhancing risk management processes. The Predict360 platform, a GRC software powered by Artificial Intelligence (AI), stands out as a comprehensive solution, particularly for financial companies. This section explores how Predict360 Risk and Compliance Management Software revolutionizes GRC frameworks by offering a unified, cloud-based system for managing risk and compliance.

It synchronizes risk and compliance with corporate strategic goals, offering a unified architecture that increases the efficiency of risk and compliance teams, enhances visibility for management, and creates electronic audit trails.

AI-Powered Solutions: Predict360 GRC software utilizes AI to streamline workflows and automate processes, providing predictive analytics and data insights for predicting risk and streamlined compliance.

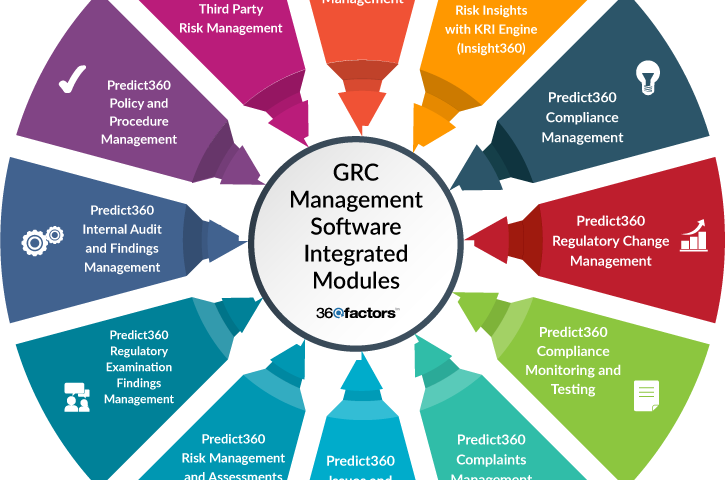

Modular and Flexible: Designed to be modular, the Predict360 GRC platform can be tailored to a company’s specific vision and requirements, allowing businesses to select only the modules and functionalities they need.

Integrated GRC Modules: The Predict360 GRC software offers a range of applications, including risk management, compliance management, regulatory change management, and more, all interconnected for enhanced functionality and insights.